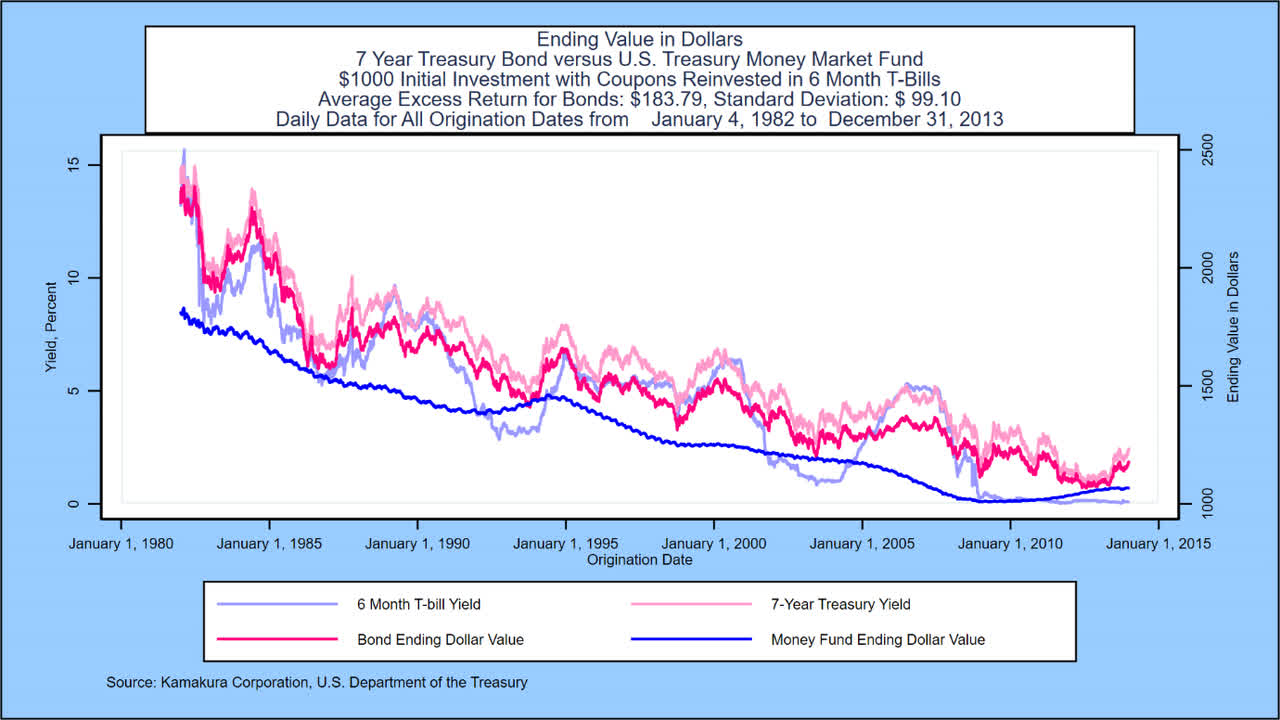

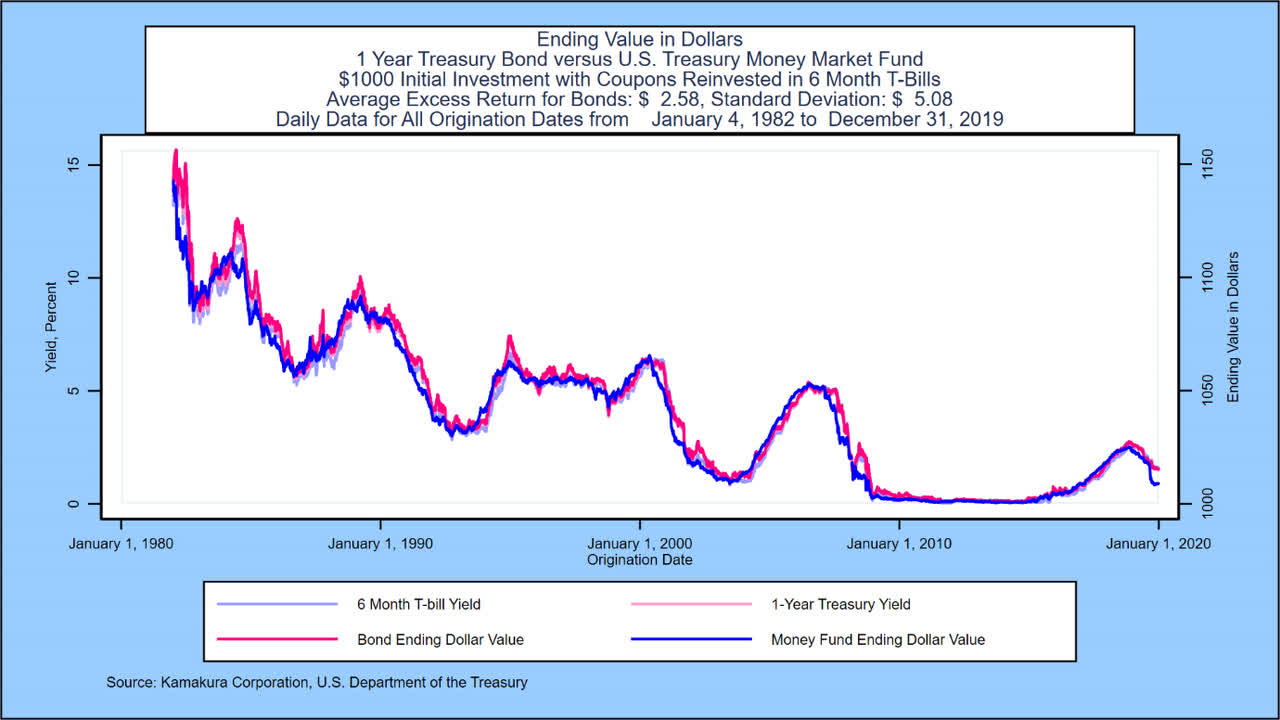

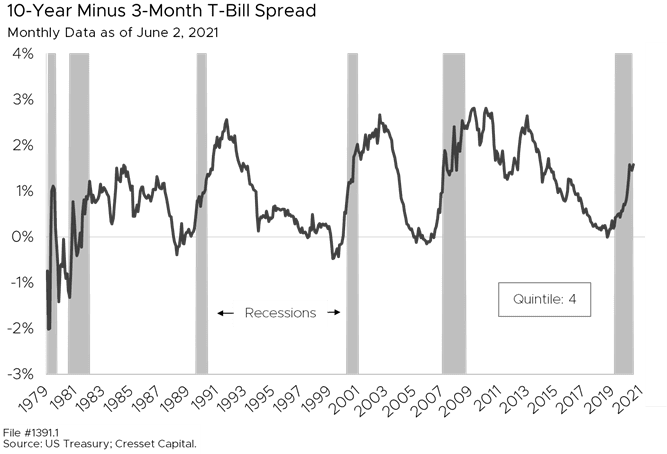

John P. Hussman, Ph.D. on Twitter: "Long bonds have also lagged T-bills - on average, not always - in periods when the yield spread is less than 2% and the 10-year Treasury

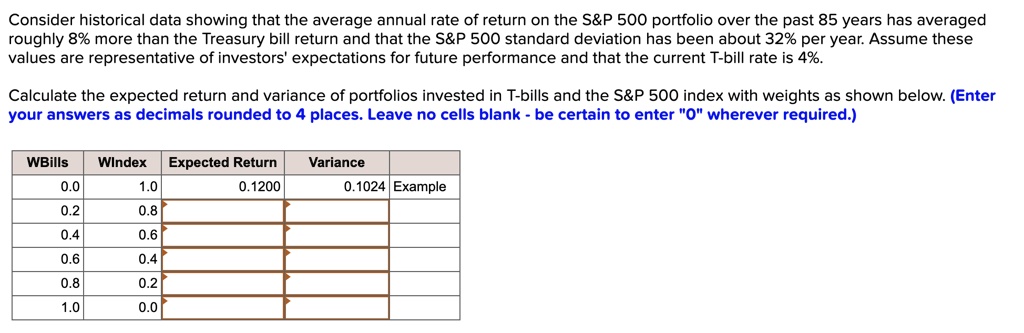

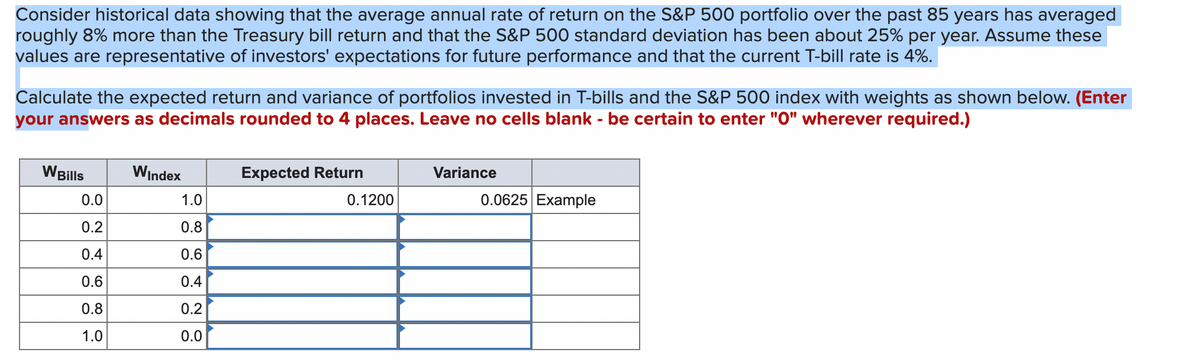

SOLVED: Consider historical data showing that the average annual rate of return on the S P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill

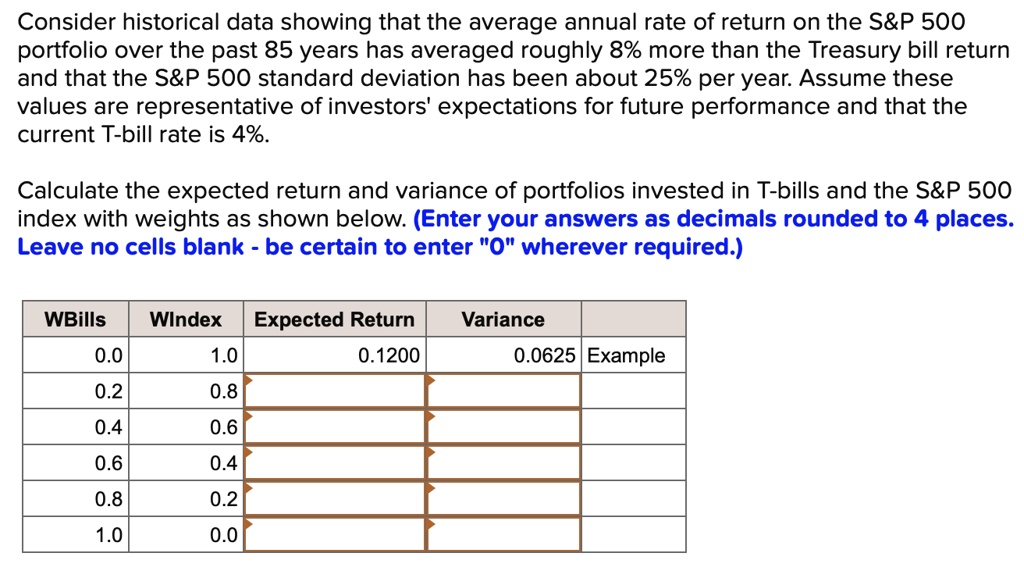

SOLVED: Consider historical data showing that the average annual rate of return on the S P 5oo portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill

:max_bytes(150000):strip_icc()/history-t-bill-auction_round1-5ceebe9e5e424997ba77185b0a8fde0a.png)